Soaring tensions over Ukraine kept world stock markets on edge on Tuesday (Feb. 22) following yesterday’s recognition of the Donetsk and Luhansk People’s Republics in eastern Ukraine by Russian President Vladimir Putin.

Putin ordered the Russian army to move into the two regions to act as “peacekeepers,” with the U.S. and allies condemning the deployment of troops in Ukraine. Germany also suspended the Nord Stream 2 gas pipeline approval, designed to transport natural gas from Russia directly to Europe.

Broader economic sanctions are expected to be announced by Washington and European Union foreign affairs ministers gathered in Brussels to discuss the bloc’s next steps.

Major US stock markets opened lower with the Dow Jones falling 0.57% at 9:31 am ET, the S&P 500 dropping 0.38% and the Nasdaq 100 declining 0.56%.

Asian-Pacific stocks retreated. In mainland China, the Shanghai Composite index was off 0.96% to 3,457.15. In Hong Kong, the Hang Seng index plunged 2.69% at 23,520. Japanese shares extended their losses for a fourth day. The Nikkei average ended down as much as 1.71% at 26,449.61. In South Korea, the Kospi was lower by 1.4% to finish at 2,706.79.

Australian markets also fell with financials, miners and tech stocks leading losses. The benchmark S&P/ASX 200 index closed 1% lower, down 72.3 points to 7,161.3, after having hit a two-week low earlier in the day. New Zealand’s benchmark NZX 50 Index slipped 0.3% to close at 12,114.63.

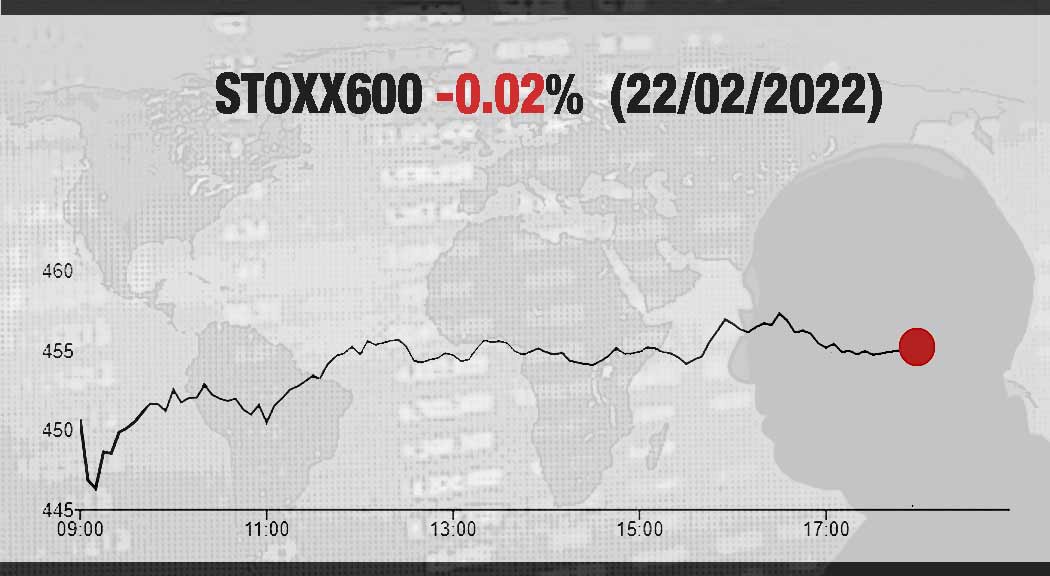

In Europe, stocks tumbled to hit a seven-month low. The pan-European Stoxx 600 index closed just 0.02% below flatline after falling just under 2% earlier in the day. Germany’s DAX closed down 0.26% at the close while France’s CAC 40 fell 0.15%.

Russian financial markets pared losses after plunging into deep red territory in the morning. The dollar-denominated RTS index of leading Russian firms closed up 1.57% while Moscow Exchange’s MOEX Russia advanced 1.58%.

The recovery began after Russia’s Central Bank on Tuesday loosened its capital requirements for Russian financial institutions citing “increased volatility.”

The regulator said banks can calculate their debt-to-capital ratios using asset prices and foreign exchange rates from last week. The rules will be in force until Oct. 1, and banks will be able to fix prices at Feb. 18 levels.

The Russian rouble depreciated to 80.9275 against the U.S. dollar in early Asian trading to its lowest level against the greenback since November 2020, before reversing course.

While no one wants a conflict, whether hot or cold, the Russia-Ukraine tensions might have an overwhelming impact on investor sentiments.

“The bottom line is that fear factor remains elevated and until we get some sort of a clearer picture of what Putin may or may not do, the market is just going to stay in a state of confusion,” Peter Cardillo, chief market economist at Spartan Capital Securities in New York told Reuters.

Investors will be busy navigating their way out of the rough waters of Ukraine scenarios.